are campaign contributions tax deductible in 2019

Donors can contribute to a political organization by donating money or goodsservices in-kind donation. If you had to repay more than 3000 that you included in.

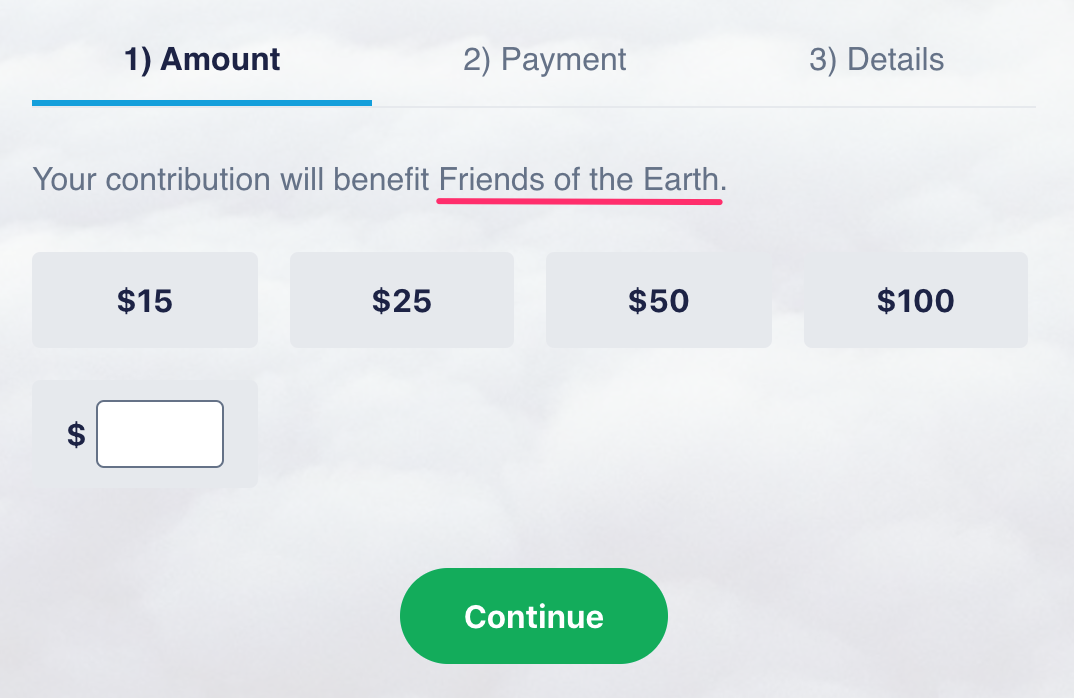

What Happens To My Money When I Donate Actblue Support

The goal of this campaign is to ensure taxpayer compliance.

. Contributions are deductible on your tax return in years when you are younger than 705 and you or your spouse earned taxable income. From Sharyl Attkisson. Repayments Under Claim of Right.

You cannot claim 120 if you only paid 40. 310 2010 was a landmark decision of the Supreme Court of the United States concerning the relationship between campaign finance and free speech. By contrast Roth IRA and Roth 401k contributions are made with after-tax dollars.

Updated January 19 2022. Which Should You Choose tax-deferred or After-tax. Self-Employed defined as a return with a Schedule CC-EZ tax form.

Contact the Self Assessment helpline if youre not sure whether a business cost is an allowable expense. The mission of the Media Research Center is to create a media culture in America where truth and liberty flourish. The court held that the free speech clause of the First Amendment prohibits the government from restricting independent.

Promised donations do not equate to tax-deductible donations. A 501c3 organization is a United States corporation trust unincorporated association or other type of organization exempt from federal income tax under section 501c3 of Title 26 of the United States CodeIt is one of the 29 types of 501c nonprofit organizations in the US. You might be wondering.

Investments held in Roth accounts also grow tax deferred but unlike traditional retirement accounts qualified. Sussmann has been charged with making a false statement to a federal agent. Some taxpayers may execute a corporate distribution and improperly deduct the costs that facilitated the transaction in the year the distribution was completed.

Costs to facilitate a tax-free corporate distribution under IRC Section 355 such as a spin-off split-off or split-up must be capitalized and are not currently deductible. When you agree to contribute 10 per month during a fund-raising drive only the monthly payments you make during the tax year can be deducted on that years return. The MRC is a research and education organization operating under Section 501c3 of the Internal Revenue Code and.

Americas 1 tax preparation provider. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. It was argued in 2009 and decided in 2010.

Although a political donation is non-deductible according to the IRS it is still wise to keep a. The annual cap on deductible contributions to health savings accounts HSAs rose in 2022 from 3600 to 3650 for self-only coverage and from 7200 to 7300 for family coverage. 547 Casualties Disasters and Thefts for more information.

But contributions will be made after-tax leaving future withdrawals tax-free. These losses are deductible as theft losses of income-producing property on your tax return for the year the loss was discovered. Federal election law appears to provide a way to pay that old debt that Rubio has yet to use.

See the Form 4684 instructions and Pub. Funds can legally be transferred between a candidates previous federal campaign committee and his current campaign committee as long the funds being transferred dont include any illegal contributions. Based upon IRS Sole Proprietor data as of 2020 tax year 2019.

1 online tax filing solution for self-employed. Contribute up to 19000 in 2019 or 25000 if youre at least 50 years of age. A political campaign donation receipt is written documentation provided to a donor for a contribution made to a political organization.

501c3 tax-exemptions apply to entities that are organized and operated exclusively for religious. Federal Election Commission 558 US. That pledge you made doesnt become deductible until you actually give the money.

Judicial Watch has filed a Freedom of Information Act FOIA lawsuit against the Central Intelligence Agency CIA requesting records of meetings and phone conversations between any CIA personnel and former Clinton campaign lawyer Michael Sussmann. You figure the deductible loss in Section B of Form 4684. You cannot claim expenses if you use your 1000 tax-free trading allowance.

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos

Part I 10 Myths About Us Investment Advisers Making Political Contributions Myths 1 5 Western Asset

Taxability Of Campaign Contributions

Political Financing Handbook For Candidates And Official Agents Ec 20155 June 2019 Archived Content Elections Canada

Taxability Of Campaign Contributions Atty Rodel C Unciano

Political Financing Handbook For Candidates And Official Agents Ec 20155 June 2019 Archived Content Elections Canada

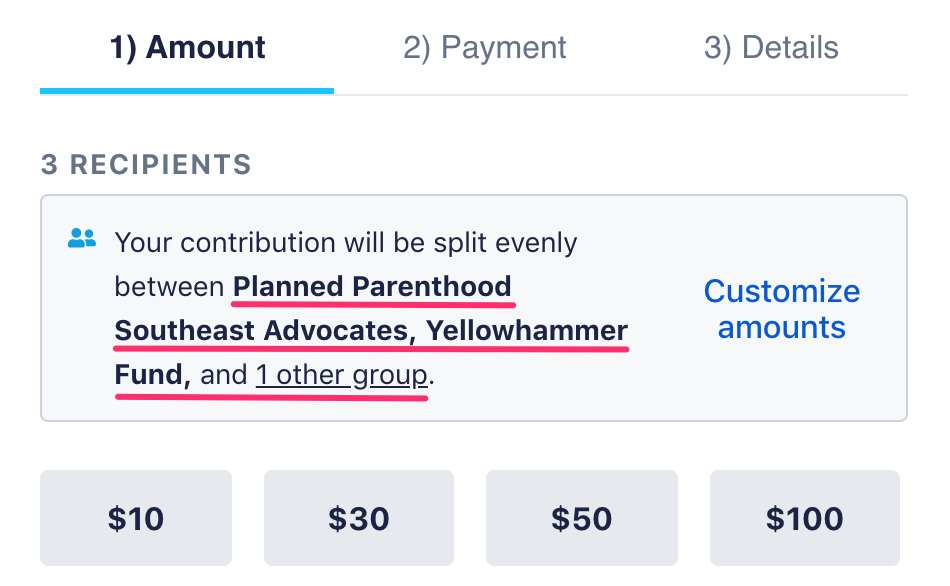

How Do I Know Who My Donation Is Going To Actblue Support

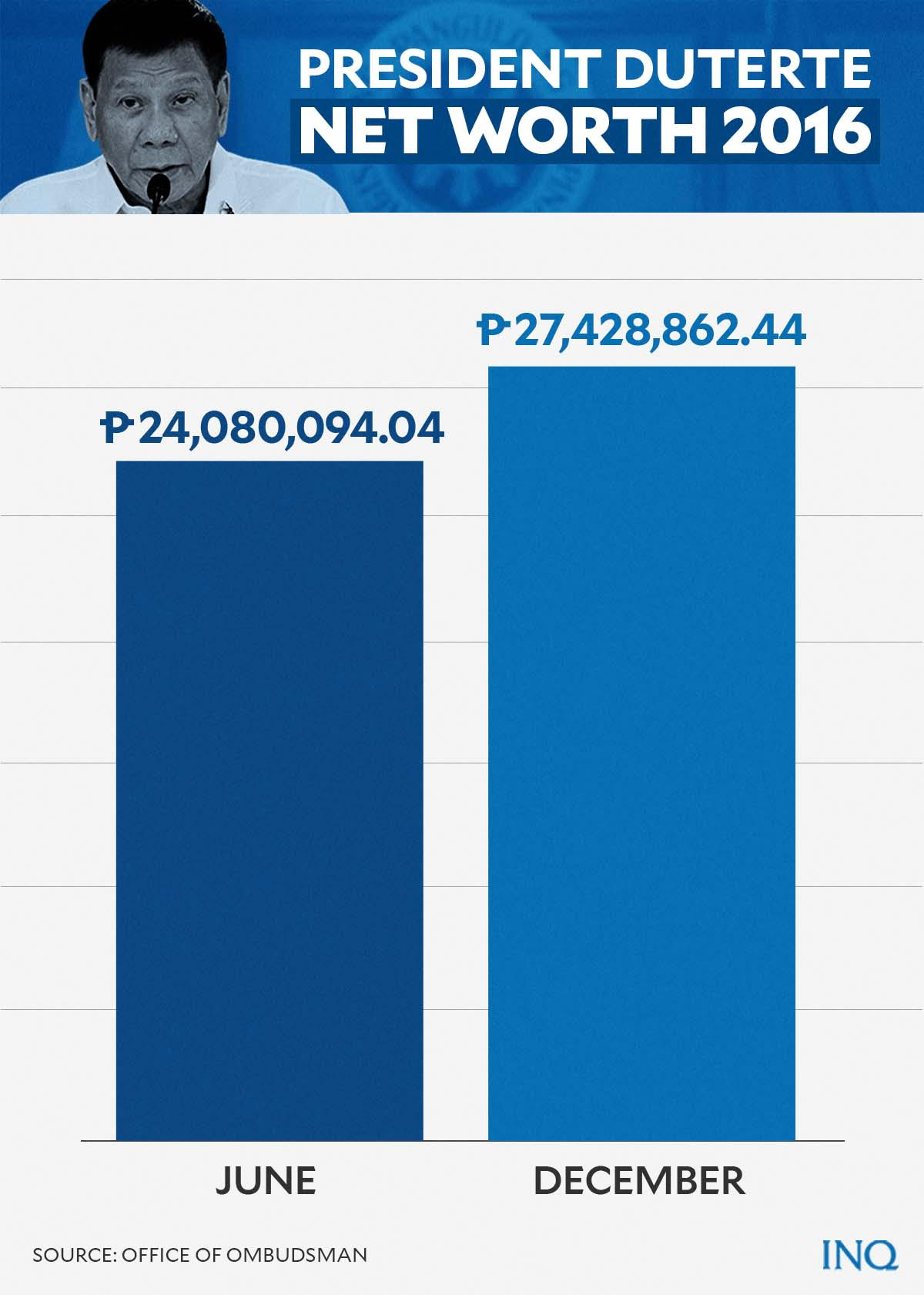

Excess Campaign Funds Taxable Income If Candidates Keep It Inquirer News

How The 3 Campaign Contribution Check Box On Your Tax Form Works Marketplace

How The 3 Campaign Contribution Check Box On Your Tax Form Works Marketplace

The Complete Political Fundraising 2022 Guide With Ideas Numero Blog

How The 3 Campaign Contribution Check Box On Your Tax Form Works Marketplace

Are Campaign Contributions Tax Deductible

Political Financing Handbook For Candidates And Official Agents Ec 20155 June 2019 Archived Content Elections Canada

Fundraising Planning Guide Calendar Worksheet Template Marketing Plan Template Fundraising Marketing Nonprofit Fundraising

Foreign Based Political Contributions And Pacs Across Time This Figure Download Scientific Diagram